south carolina inheritance tax 2020

Manage Your South Carolina Tax Accounts Online. Extension SC8736 South Carolina Department of.

South Carolina Income Tax Calculator Smartasset

State Inheritance Taxes.

. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. That way a joint bank account will automatically pass. Federal Estate Tax.

This tax is portable for married couples meaning that if the right legal steps are taken a married couples estate of up to 234 million is exempt from the federal estate tax when both spouses. Contrary to what many people think federal estate taxes do not apply to the. Writer must be at least 18 years.

Will must be signed by the writer and two. If they are married the spouse may be able to leave everything to each other without paying any estate tax. In addition gifts to spouses who are not US.

This site will help. This site will help. The top estate tax rate is 16 percent exemption threshold.

Writer must be of sound mind and body. - 2020-09-14 - 2020-09-15 035542 - 12 What Pawleys Island SC residents need to know about Inheritance Law What South Carolina Residents Need to Know About Inheritance Law - 28 -. - 2020-09-14 - 2020-09-15 035542 - 12 What Saluda County SC residents need to know about Inheritance Law What South Carolina Residents Need to Know About Inheritance Law - 28 -.

The SC Department of Revenue publishes online tutorials and sponsors tax seminars and workshops throughout the. Orangeburg takes the top spot as the most dangerous city in South Carolina based on the most recently reported FBI data -- 2020. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Creating a will is oftentimes the first step that South Carolina residents must take in estate planning. This increases to 3 million in 2020 Mississippi. The top estate tax rate is 16 percent exemption threshold.

South Carolina Income Tax Range. South Carolina has no estate tax for decedents dying on or after January 1 2005. 3 on taxable income from 3200 to 16039 High.

Securely file pay and register most South Carolina taxes using the SCDORs free online tax portal MyDORWAY. The requirements for a valid will change from state to state but are pretty straightforward in South Carolina. - 28 - - - 2020-09-14 - 2020-09-15 035542 - 12 What Bishopville SC residents need to know about Inheritance Law What South Carolina Residents Need to Know About Inheritance Law.

No estate tax or inheritance tax. And in. However according to some inheritance laws of South Carolina not all the deceased persons property may be considered as a part of the estate.

Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa Kentucky Maryland Nebraska New Jersey and PennsylvaniaNotice that Maryland and New Jersey collect both state estate taxes and inheritance taxes. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

South Carolina also does not impose an Estate Tax which is a tax taken from the deceaseds estate soon after the loved one has passed. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Federal estate tax The federal estate tax is applied if an inherited estate is more than 1158 million in 2020. Even though there is no South Carolina estate tax the federal estate tax might still apply to you. And while Hartsville didnt record a single murder in 2020 it still had the 13th highest rate of violent crime in South Carolina.

A married couple is exempt from paying estate taxes if they do not have children. States Without Death Taxes. South Carolina Department of Revenue.

Like estate taxes and inheritance taxes South Carolina also does not have a gift tax. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

However you are. Check the status of your South Carolina tax refund. It has a progressive scale of up to 40.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. Understand the different types of trusts and what that means for your investments. No estate tax or inheritance tax.

The federal estate tax exemption is 117 million in 2021. Only a few states collect their own estate or inheritance tax. It can be confusing to sort out the process the taxes and the issues that arise after someones death.

Does South Carolina Have an Inheritance Tax or Estate Tax. Still individuals who are gifted more than 15000 in one calendar year are subject to the federal gift tax. No estate tax or inheritance tax.

1158 million in 2020 the estate is subject to an estate tax. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Find out if South Carolina collects either or both taxes on the estate after someone has died.

65 on taxable income over 16039 Beginning with the 2023 tax year and each year thereafter until it. It can be confusing to sort out the process the taxes and the issues that arise after someones death.

A Guide To South Carolina Inheritance Laws

Real Estate Property Tax Data Charleston County Economic Development

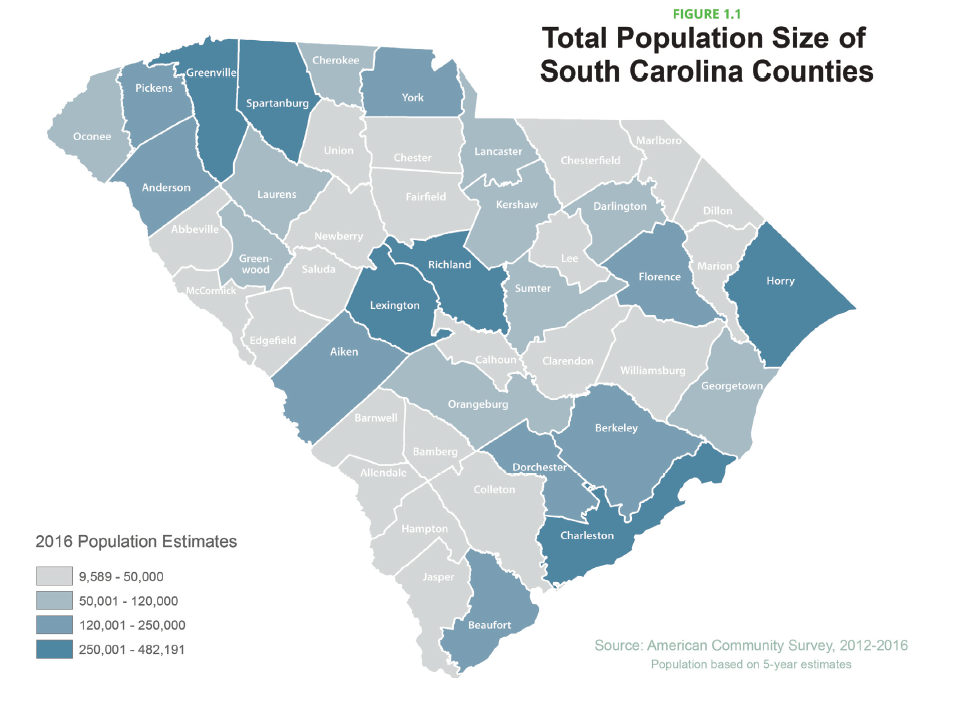

South Carolina Health At A Glance 2018 Live Healthy State Health Assessment Report Demographics Scdhec

The Pros And Cons Of Retiring In South Carolina

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

17 Things You Must Know Before Moving To South Carolina

12 Best Places To Live In South Carolina

2021 South Carolina Manufacturing Facts Nam

South Carolina Inheritance Laws What You Should Know Smartasset

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

South Carolina Retirement Tax Friendliness Smartasset

Ultimate Guide To Understanding South Carolina Property Taxes

The True Cost Of Living In South Carolina

South Carolina Lawmakers Reach Deal To Cut Income Tax